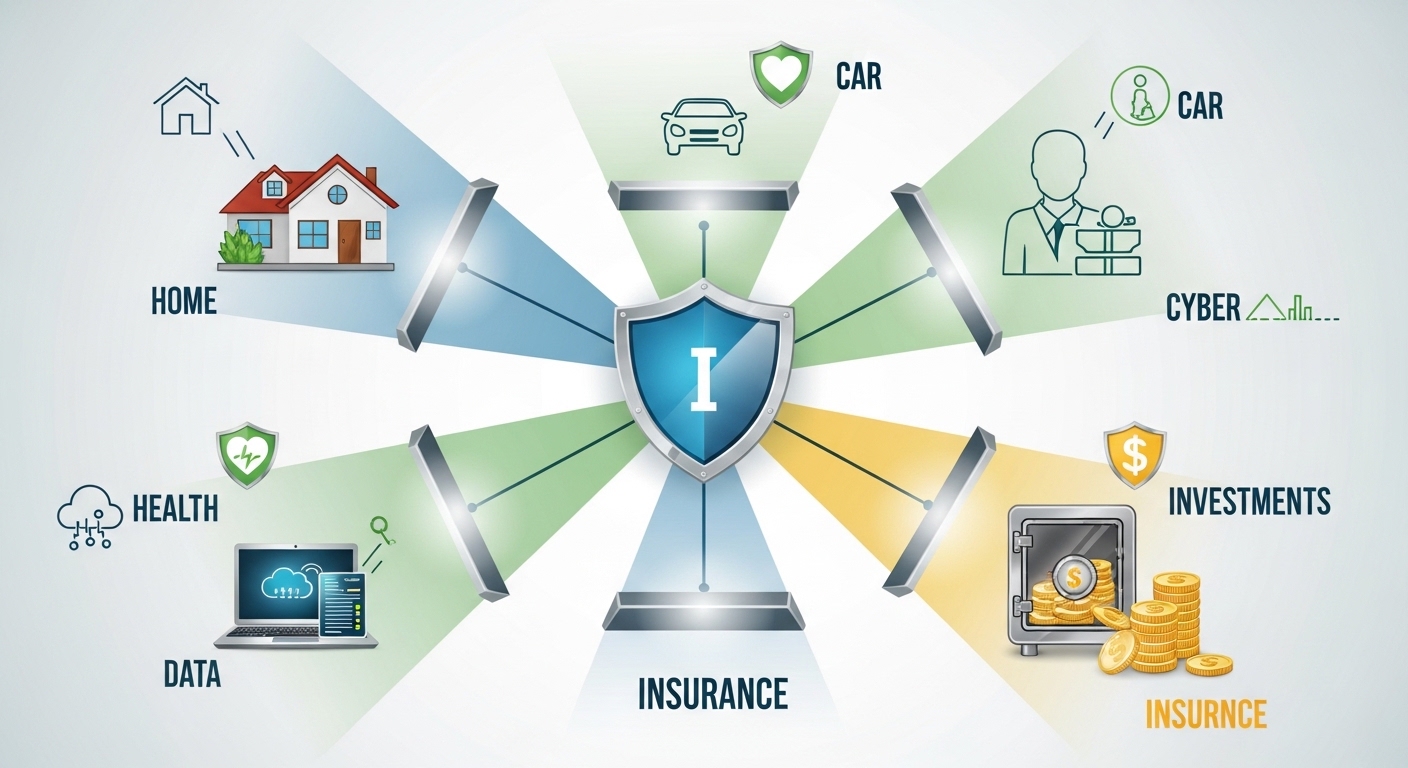

Insurance is an essential component of a sound financial plan, serving as both a safety net and a tool for peace of mind. It enables individuals, families, and businesses to recover from unexpected setbacks without compromising their long-term goals or stability. Whether you are seeking to protect your property, your health, or your future income, understanding the specifics of insurance coverage helps you make informed decisions. For example, homeowners and renters alike can benefit from specialized policies, such as apartment insurance Irvington, NJ, designed to address the unique risks of apartment living in New Jersey.

The right insurance policy goes beyond mere financial reimbursement. It provides reassurance that if a disaster were to strike, you have a recovery plan. With the prevalence of natural disasters, cyber threats, and shifting economic conditions, investing in comprehensive insurance coverage has become increasingly vital. While insurance may seem like an expense, it is, in reality, an investment in stability and security for both the present and the future.

Home Insurance: Shielding Your Sanctuary

Your home is likely the most significant single investment you will ever make, and it deserves the highest level of protection. Home insurance serves as a safeguard against losses from fire, natural disasters, theft, and vandalism. According to the latest data from the New York Times, the frequency and cost of property-related claims have increased in recent years, underscoring the need for robust coverage that matches your property’s actual value.

In addition to standard homeowners’ insurance, renters and apartment dwellers can access policies tailored to their unique needs. These policies help cover damages to personal belongings, liability claims from visitors, and even temporary relocation costs if a covered event makes your home uninhabitable.

Auto Insurance: Protecting Your Journey

Every driver faces risks on the road, regardless of experience or caution. Auto insurance protects not only your vehicle, but also your finances and personal liability in case of an accident. With the average cost of a new vehicle on the rise and medical expenses related to accidents climbing each year, comprehensive and collision coverage is increasingly recommended.

Many insurance providers offer discounts for safe driving, installing safety features, and maintaining a good claims record. These incentives help lower costs while ensuring you remain protected against financial hardship in the event of an incident. Additionally, state regulations often require certain minimum levels of auto insurance, making it not just wise, but also legally necessary.

Life Insurance: Ensuring Your Loved Ones’ Future

Life insurance is a cornerstone of family financial planning, offering income replacement and peace of mind for your loved ones. In the event of your untimely passing, a solid policy can cover funeral expenses, pay off outstanding debts, and provide your family with the resources needed to maintain their standard of living. A recent CNBC report highlights the importance of tailoring your policy to your family’s unique needs and financial goals.

There are various forms of life insurance, from term to whole life, that can be adapted as life circumstances change. Whether you are planning to support young children, aging parents, or to relieve your loved ones of financial stress, selecting the right policy is an act of foresight and care.

Health Insurance: Maintaining Well-being

Healthcare costs in the United States continue to increase, making health insurance more crucial than ever. A comprehensive health insurance plan helps cover the costs of doctor visits, hospitalization, surgeries, and prescription medications. It also provides access to preventive care that can reduce future health complications and costs.

Delaying or forgoing medical treatment due to financial concerns can have long-term consequences for your well-being. By investing in a health insurance plan specific to your needs and circumstances, you ensure timely and proper care, as well as the ability to plan and manage potential health expenses proactively.

Business Insurance: Securing Your Livelihood

For entrepreneurs and business owners, insurance is key to managing risk and ensuring operational continuity. Business insurance can cover property damage, liability claims, employee injuries, and even business interruption losses. According to the Forbes Advisor, having appropriate commercial coverage is essential to protecting your investment and reputation in the marketplace.

The right mix of general liability, property, and specialized insurance policies can help you weather unexpected events without facing catastrophic financial setbacks. Choosing a reputable provider and regularly reviewing your policies ensures your coverage evolves with your business.

Cyber Insurance: Safeguarding Digital Assets

With the digital transformation accelerating across every industry, cyber insurance is no longer limited to tech firms. Any company or individual storing sensitive information online risks exposure to cyberattacks, data breaches, and financial theft. Cyber insurance helps mitigate losses from these threats, including ransomware damage or liability from data leaks.

Many policies also provide access to cybersecurity professionals and rapid-response services to help manage and recover from incidents. As digital threats become more sophisticated, investing in cyber insurance is an essential step in protecting your digital footprint.

Umbrella Insurance: Extra Layer of Protection

Even with primary insurance policies in place, extraordinary events or lawsuits can exceed your standard liability limits. Umbrella insurance provides a crucial back-up, kicking in when your base coverage is exhausted. This type of policy is especially valuable for those with significant assets or higher risk profiles, offering extended protection against potential legal costs, settlements, or claims.

For many, umbrella insurance is a cost-effective solution to enhance peace of mind, knowing that a central claim will not derail years of careful financial planning and investment.

Conclusion

Insurance is more than a regulatory requirement; it is a shield that protects your most cherished assets and your future. By understanding the different types of insurance and tailoring your coverage to fit your lifestyle, you can navigate life’s uncertainties with confidence. Investing in appropriate policies today means building resilience for whatever tomorrow may bring.