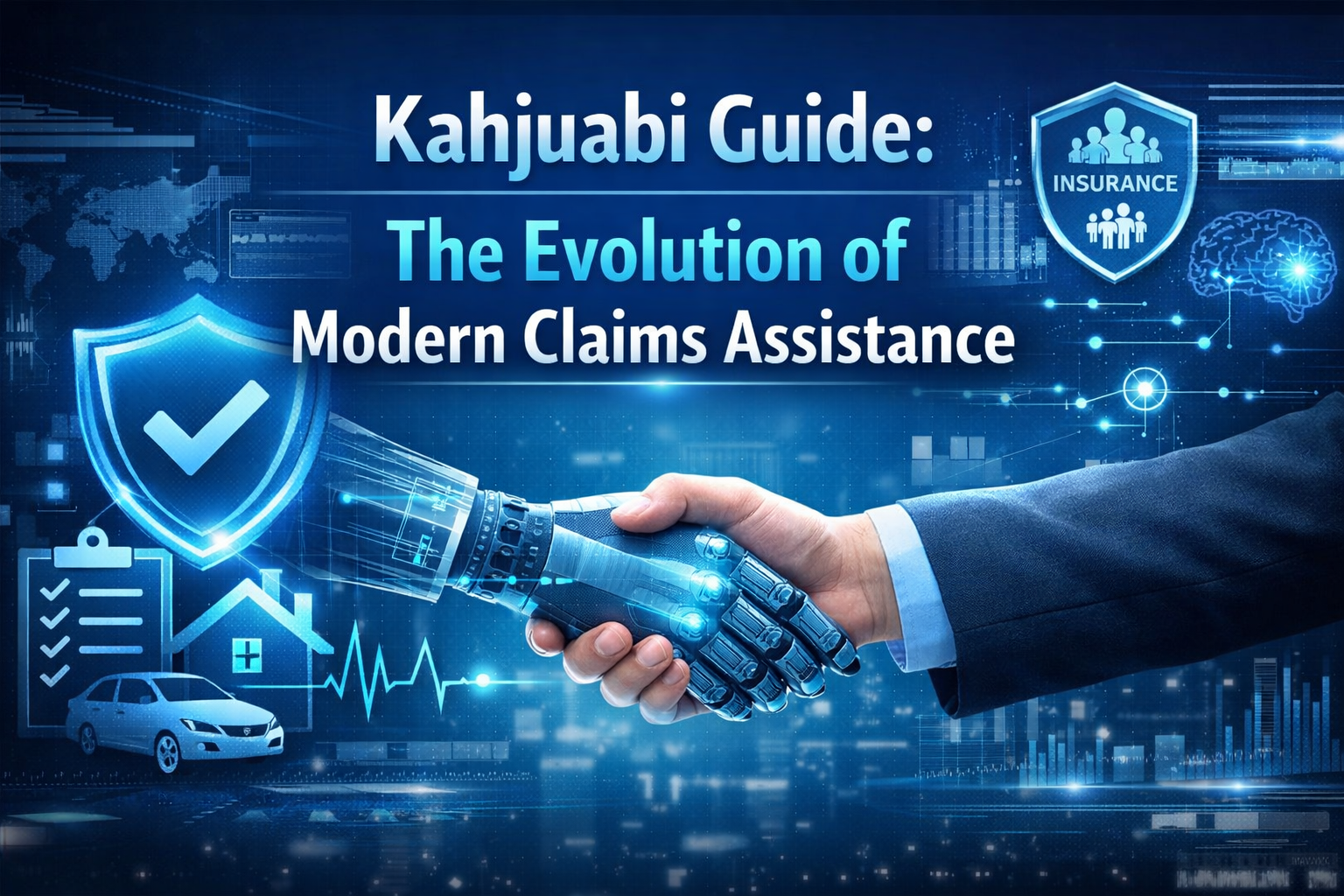

In an era defined by economic volatility and increasingly complex logistical chains, the traditional insurance contract—a simple promise to indemnify after the fact—is no longer sufficient. Modern enterprises and high-net-worth individuals are shifting their focus from mere reimbursement toward immediate, high-touch intervention. At the center of this transformation lies the concept of Kahjuabi, a sophisticated model of claims assistance that prioritizes real-time recovery over delayed compensation.

Defining Kahjuabi: The Modern Context of Integrated Recovery

Kahjuabi is a comprehensive service framework designed to provide 24/7 proactive assistance, legal advocacy, and logistical coordination immediately following a loss event. Originally popularized within the advanced InsurTech ecosystems of Northern Europe, the term refers to the strategic bridging of the gap between an accident occurring and a claim being finalized. It represents a transition in the insurance relationship from a passive payout mechanism to an active, real-time crisis management partnership.

Why Kahjuabi is Trending: The Shift from Payouts to Partnerships

The current surge in interest regarding Kahjuabi-style services is driven by a fundamental change in consumer expectations. In the digital age, waiting weeks for a claims adjuster to assess damage is viewed as an operational failure. Today’s market forces demand “Concierge Claims”—a model where the insurer or a specialized third-party partner assumes the burden of documentation, emergency repairs, and legal navigation instantly.

Furthermore, the rise of the gig economy and decentralized business models has created new vulnerabilities. Whether it is a logistics firm facing a maritime dispute or a homeowner dealing with a complex structural failure, the need for an expert “on-call” advocate has moved from a luxury to a baseline requirement for financial stability.

Strategic Advantages: Beyond Traditional Indemnity

Implementing a Kahjuabi-driven approach offers distinct competitive advantages that traditional insurance models lack. The primary benefit is the mitigation of secondary loss. By providing immediate guidance, these services prevent minor issues from escalating into catastrophic financial burdens.

| Feature | Traditional Insurance | Kahjuabi Model |

|---|---|---|

| Response Time | Reactive (Days/Weeks) | Proactive (Immediate/24/7) |

| Focus | Financial Reimbursement | Operational Continuity & Advocacy |

| Documentation | User-Led Burden | Expert-Led Coordination |

| Legal Support | Limited/Separate | Integrated Claims Advocacy |

The ROI of Immediate Intervention

From a corporate perspective, the return on investment for Kahjuabi services is found in the reduction of downtime. In manufacturing or transport, a 48-hour delay in claims processing can result in six-figure revenue losses. By deploying expert assistance to the site of an incident within hours, firms can bypass the bureaucratic friction that usually stalls recovery.

The Architecture of Response: How Modern Claims Assistance Operates

The efficacy of Kahjuabi rests on three critical pillars: Ubiquity, Expertise, and Autonomy.

- Ubiquity: Services must be accessible across borders, especially for industries like logistics and international travel where losses rarely happen in convenient jurisdictions.

- Expertise: Unlike a standard call center, a Kahjuabi provider employs legal specialists and engineers who can make technical assessments on the fly.

- Autonomy: The most effective systems grant the assistance team the power to authorize emergency spending or repairs without waiting for multi-level corporate approval.

Impact on Global Risk Management

As this model gains traction globally, we are seeing a “de-commoditization” of insurance. Companies are no longer choosing providers based solely on the lowest premium, but on the robustness of their assistance network. In high-risk sectors, the Kahjuabi framework is becoming a vital component of Environmental, Social, and Governance (ESG) strategies, as it demonstrates a commitment to rapid recovery and stakeholder protection.

Challenges & Considerations: The Human vs. Digital Balance

While AI and automated claims processing are streamlining simple losses, the true value of Kahjuabi remains human-centric. The primary challenge facing the industry is scalability. Providing high-level expert advocacy 24/7 is resource-intensive. As providers look to integrate AI, they must ensure that the “empathy gap” is not widened; a person in the midst of a crisis requires a sophisticated human advocate, not just an efficient algorithm.

Common Questions About Kahjuabi

Is Kahjuabi the same as a claims adjuster?

No. A claims adjuster typically works for the insurance company to assess the value of a loss. Kahjuabi is an assistance service that works to help the policyholder navigate the recovery process, often acting as an advocate to ensure the claim is handled fairly and quickly.

Does Kahjuabi cover all types of insurance?

While most common in motor and property insurance, the framework is expanding into professional liability, cyber-risk, and maritime insurance, where the complexity of the “aftermath” is highest.

Is this service available globally?

While the term originated in specific European markets, the “Claims Assistance as a Service” (CAaaS) model is now a global standard adopted by major international brokerages and boutique risk firms.

How does Kahjuabi affect insurance premiums?

While adding comprehensive assistance may slightly increase the initial premium, the long-term cost of risk is often lower due to the prevention of secondary damages and faster return to operations.

The Bottom Line

The emergence of Kahjuabi signals a maturing of the financial services sector—a realization that capital alone cannot solve a crisis. In a world of interconnected risks, the value of an insurance policy is increasingly measured by the quality of the help provided in the first sixty minutes of a loss, rather than the check sent sixty days later. For businesses and individuals alike, the transition to proactive recovery is not just a trend; it is a strategic necessity for the 2025 risk landscape.