In the digital era, government transactions and financial transparency have become essential components of public administration. The Public Financial Management System (PFMS) is a revolutionary platform introduced by the Indian government to streamline the distribution and monitoring of funds under various schemes. The PFMS login system acts as a digital bridge between government departments, banks, and beneficiaries, ensuring that every rupee reaches its rightful recipient without delay or corruption. This article explores the PFMS portal in depth—its purpose, login process, benefits, and significance in enhancing financial governance across India.

What is PFMS?

The Public Financial Management System (PFMS) is an integrated web-based platform developed by the Office of the Controller General of Accounts (CGA) under the Ministry of Finance, Government of India. Initially launched in 2009 as a scheme monitoring system, PFMS has evolved into a robust financial management and payment gateway. It allows real-time tracking and efficient distribution of funds released by the government to various programs, departments, and individuals.

By digitizing fund flow and monitoring expenditures, PFMS ensures accountability and transparency in the government’s financial operations, significantly reducing leakages and delays.

Purpose of the PFMS Portal

The PFMS portal was created to provide a centralized and transparent platform for handling public funds. Its primary objectives include:

- Ensuring timely and direct transfer of funds to beneficiaries.

- Eliminating intermediaries in the payment process.

- Providing real-time monitoring of fund utilization.

- Enhancing transparency and efficiency in the financial system.

Through this system, the government can effectively track every transaction, ensuring that funds are used as intended under various central and state-sponsored schemes.

Importance of PFMS Login

The PFMS login portal is not just a digital tool—it’s the entry point for millions of users including government officials, institutions, and beneficiaries. Logging into the PFMS system allows users to access crucial functions such as fund disbursement, tracking of payments, account validation, and report generation.

For government employees, PFMS login helps in sanctioning and approving payments. For beneficiaries, it provides a transparent view of payment status and history, ensuring they receive funds under schemes like scholarships, pensions, or subsidies.

How to Access PFMS Login Portal

Accessing the PFMS login portal is simple and user-friendly. To log in, follow these steps:

- Visit the official website at https://pfms.nic.in.

- On the homepage, click on the “Login” button in the top-right corner.

- Select the appropriate login type (such as Program, Agency, or Pay & Accounts Office).

- Enter your User ID, Password, and Captcha Code.

- Click on Login to access your account.

Once logged in, users can perform tasks like managing funds, generating reports, or verifying beneficiary accounts.

PFMS Registration Process

Before logging in, new users must complete a registration process. Agencies or institutions that wish to use PFMS for fund disbursement need to register themselves on the portal. The process includes:

- Visiting the PFMS homepage.

- Selecting “New User Registration.”

- Filling in organizational details such as name, email, IFSC code, and contact information.

- Submitting bank and scheme details for verification.

- Receiving login credentials via email once approved.

This ensures that only authorized users gain access to government fund management operations.

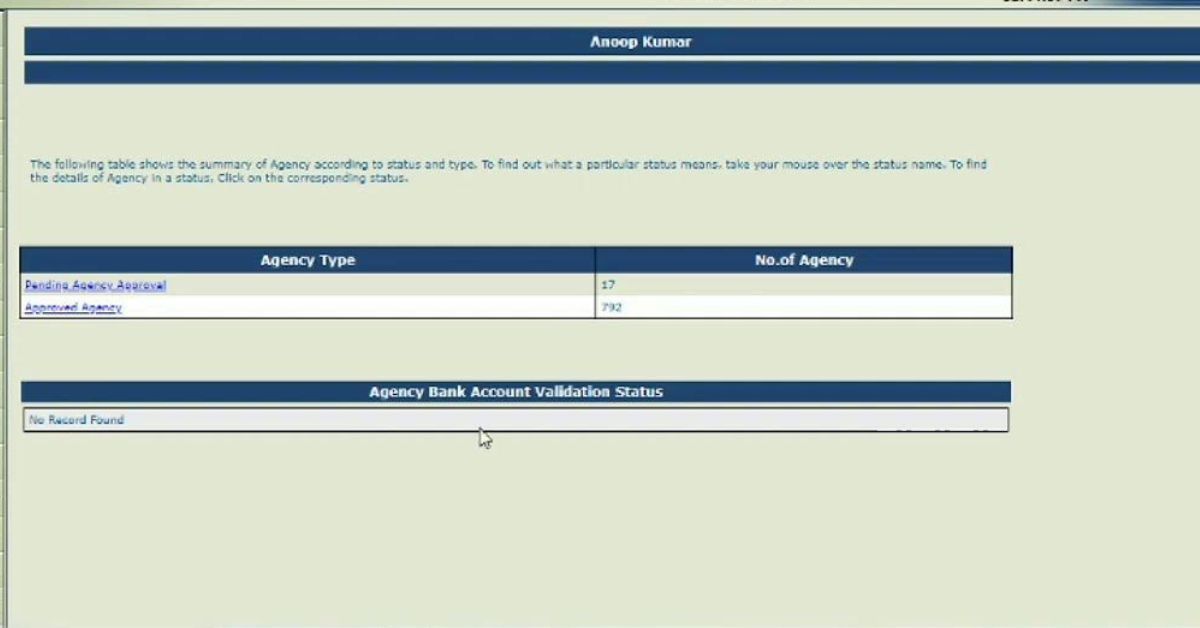

PFMS Login for Different User Types

The PFMS portal supports various types of logins depending on user roles and responsibilities. The main user categories include:

- Agency Login – For departments or institutions handling funds for government schemes.

- Program Division Login – For officials monitoring and approving fund allocations.

- Pay and Accounts Office Login – For finance officers managing budget allocations and payments.

- Beneficiary Login – For students, pensioners, and individuals checking their payment status.

Each user type has specific privileges and access levels within the PFMS system, ensuring data security and role-based operations.

Key Features of the PFMS Portal

The PFMS system comes with a range of features designed to simplify fund management and enhance financial accountability:

- Real-Time Fund Tracking: Provides up-to-date information on fund transfers and balances.

- Direct Benefit Transfer (DBT): Ensures direct payment to beneficiaries’ bank accounts.

- Integration with Banks: PFMS is connected with over 100 banks for seamless transactions.

- Automated Reconciliation: Matches and reconciles accounts automatically for accuracy.

- Report Generation: Generates detailed expenditure and utilization reports for departments.

These features make PFMS one of the most efficient public finance management systems globally.

PFMS and Direct Benefit Transfer (DBT)

The integration of PFMS with the Direct Benefit Transfer (DBT) scheme has been one of the government’s most successful financial reforms. Through this system, subsidies and welfare payments are directly credited into beneficiaries’ bank accounts linked with Aadhaar.

PFMS plays a critical role in authenticating beneficiaries, processing payments, and monitoring the flow of funds. This integration has drastically reduced fraud, corruption, and delays in payment distribution, ensuring that benefits reach the intended recipients without middlemen.

Tracking Payments Through PFMS

Beneficiaries can track their payment status easily using the PFMS portal. To check the payment, users should:

- Visit https://pfms.nic.in.

- Click on “Know Your Payments.”

- Enter details such as bank name, account number, and captcha code.

- View the current status of fund transfer and payment history.

This transparency ensures that beneficiaries stay informed about their transactions and can raise queries if delays occur.

Benefits of Using PFMS

PFMS offers numerous benefits for both government departments and beneficiaries.

- Transparency: Every transaction is recorded and traceable.

- Accountability: Departments can monitor how funds are utilized.

- Efficiency: Reduces manual paperwork and delays.

- Security: Protects user data through encrypted connections and multi-level authentication.

- Accessibility: Users can log in anytime, anywhere using an internet-enabled device.

These benefits have made PFMS a cornerstone in India’s mission toward digital governance.

Challenges Faced in PFMS Implementation

Despite its success, PFMS faces challenges like connectivity issues in rural areas, lack of training among users, and occasional server downtime. Some departments also struggle with integration between state and central databases. However, the government continues to improve infrastructure and provide capacity-building workshops to overcome these hurdles.

Steps to Reset PFMS Login Password

If a user forgets their PFMS password, it can be easily reset through the portal:

- Go to the PFMS login page.

- Click on “Forgot Password.”

- Enter your user ID and registered email ID.

- Follow the instructions sent to your email to create a new password.

This simple process ensures uninterrupted access to your PFMS account.

PFMS Mobile Accessibility

To enhance user convenience, PFMS is compatible with mobile devices, allowing users to log in and access services through smartphones and tablets. Although there isn’t a dedicated app yet, the website’s responsive design ensures smooth navigation and functionality across all devices.

Security and Data Protection in PFMS

Given the sensitive nature of financial transactions, PFMS employs advanced security measures. It uses SSL encryption, role-based access control, and two-factor authentication to protect user data. Regular audits and monitoring further ensure that no unauthorized access occurs, maintaining the credibility and reliability of the system.

PFMS’s Role in Digital India

PFMS is one of the core pillars of the Digital India initiative, promoting transparency, digital payments, and e-governance. It aligns with the vision of creating a technology-driven ecosystem where public money is managed efficiently. By reducing dependency on paper-based records and promoting real-time financial tracking, PFMS has transformed how government finances are managed.

Conclusion

The PFMS login system is much more than a technical tool—it’s a revolution in India’s financial governance. By ensuring transparency, accountability, and efficiency in public fund management, PFMS has set a new benchmark for digital administration. It empowers both the government and beneficiaries by enabling direct fund transfers, real-time monitoring, and secure digital payments. As India continues to embrace technology, PFMS stands as a shining example of how digital platforms can make governance more inclusive, efficient, and transparent.

FAQs

- What is the official website for PFMS login?

The official website is https://pfms.nic.in. - Who can use the PFMS portal?

Government officials, agencies, institutions, and beneficiaries receiving government funds can use the PFMS portal. - How do I check my PFMS payment status?

Visit the website, click “Know Your Payments,” and enter your bank details to track your payment. - Is PFMS linked with Aadhaar?

Yes, PFMS integrates with Aadhaar for beneficiary verification and DBT payments. - Can PFMS be accessed on mobile?

Yes, PFMS can be accessed via mobile browsers for convenient login and tracking.